Click on above images to enlarge

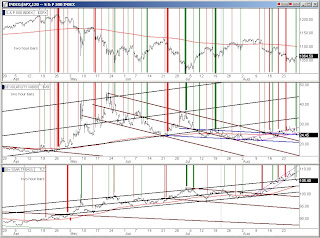

The markets rallied nicely as Bernanke spoke, he reminded everyone that they have a lot of tools at their disposal if things get worse and they might even take "unusual measures" but did not specify what they might be. The real reason the market rallied Friday is that we completed a nice "W" setup as can be seen in the lower chart cluster, row 2, from Aug 24 to Friday's close. This W bottom is also using the 6/8 low, marked with the thin red line, as its basing level. This had a profound effect on the bonds and the vix seen in the upper chart cluster. The bonds fell out of their pink line ascension channel and dropped all the way back into the thick black line mother channel. Which means a lot of people closed their short term longside bond positions and jumped to the stock market quickly. In the vix chart just above it, we see the vix dropped out of it's ascension channel and just barely re-entered its blue line downhill midterm channel. This triggered a #1 & #2 green vix and bond buy signal as I have marked.

In the lower chart cluster, row 3 chart 3, we see that the advance decline is approaching seriously overbought at the close Friday. So at least a little pullback would be in order unless they do the classic move I mentioned a couple of times before where they hold all big caps firm and drop the other stocks considerably so that the adv/dec returns to the bottom green buy level without the indexes having to fall back with it.

Obviously, Bernanke and bailout team want this to be a level they hold and build from. However, Bernanke did make it clear that although they have all these tools at their disposal that they would not implement them for the foreseeable future which equates to either the economic situation is not bad enough for them to act now or they want to create the impression that the economic situation is not bad enough to act now. A little reminder that we are heading into election season and it is rare if anything helpful, good, or constructive gets passed by lawmakers during the run up to election. The Fed has a history of laying low and trying not to seem political until after the Nov elections have passed. If they could drive the markets up from this level, no unusual measures will be needed before then and every point higher we get on the S&P will help to undo the upside down red 5 green 10 pushdown retest that has setup on the 30yr chart in the lower cluster, row 3 chart 1. That is truly the chart to watch as it changes during an up move if they can keep it going.

Alan