Stock Market Technical Analysis Blog

Click on above images to enlarge

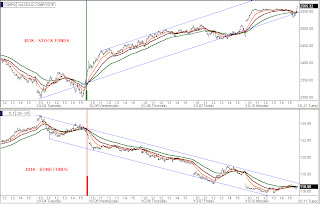

It looks like our traditional end of year stock market rally has officially begun. The 10 weeks of making big money playing the bond market long looks to be done because the TLT has now been two days out of its 10-week uphill channel and its day 5 EMA crossed down thru its Day 10 EMA late this afternoon (its upcross back on 7/29 is what began the 10-week long bonds position trade). The vast majority of the bond position traders are starting to exit their position trades as the day 5/10 downcross is the most widely used exit signal on bonds. Technically the official confirmation is when the bonds open the day after with the 5 still under the 10, but I believe it's safe to go ahead and say the 10-week position trade is over. However I will wait until tomorrow morning before marking in my major bond sell signal which would be the thick red line on its chart and also add the major stock buy signal (thick green line on chart 1, set 1) to open up a stocks position trade to hold for several weeks.

Looking at the stocks, the last minor buy signal I posted was last Tuesday (top chart set, chart 1) and after having seven days of good gains it almost makes me nervous to continue holding but everything looks to be pointing to the stock market having officially started its seasonal 6-8 week run up as Xmas approaches. Even though tomorrow is the seventh day of my last Minor bonds to stock switch signal I will stay in stocks side trade until it exhausts itself and if volume increases it may be a while. One more notable item, the VXX broke down out of its 10-week uphill channel in the last 30 minutes which was the last channel that needed to be breached for the stock market to take off.

Alan

Please see risk disclaimer below