Stock Market Technical Analysis Blog

Click on above images to enlarge

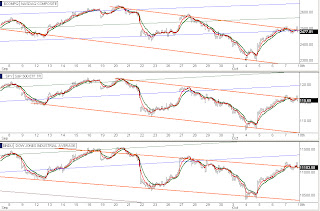

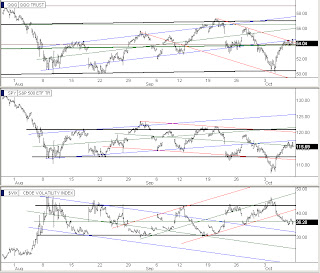

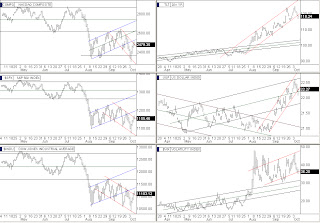

At today's open the NASDAQ broke up out of its downhill channel but the breakout soon failed and it slipped back into it midday, then at 45 minutes until the close the PPT jammed the stock market hard for a fierce pop up out of the downhill again and in the last 20 minutes it fell back into the downhill channel a second time (as can be seen in the second chart set). While the stock market was busy rolling in schizophrenia the UUP (dollar index), the bonds (TLT) and the VIX (volatility index) were all quietly getting themselves set up and ready for their next leg up in their channels (shown in chart set 3).

While everyone knows the stock market has had its 3-4 day run and now its the dollar and bonds turn to have a 3-4 day run up, the PPT is bent on not letting the stock market pass the baton to the bond market here. Their intervention in today's market produced a ridiculous roller coaster ride in the stock indexes. Even through the manipulation the dollar, bonds, & VIX did get completely set up ready to lift Monday morning. The reason they are so desperately trying to keep the NASDAQ from cycling downward now can be seen in the third chart set where continuing down in its orange channel will completely remove the NASDAQ from its uphill blue channel.

Just looking at the NASDAQ & SPY charts paints a pretty bearish picture looking towards Monday and the dollar & bonds are looking equally bullish. However, if they step back into the market on Monday to try one more time to save the NASDAQ's blue line channel then anything could happen. If they don't step in the bond market's turn at cycling up definitely looks poised to start.

Alan

Please see risk disclaimer below