Stock Market Technical Analysis Blog

Click on image to enlarge

Following up from Tuesday night's blog where I mentioned that Bernanke should take advantage of an exceptional opportunity that was set up in AAPL for him to use it to change the market's current pivot to the upward direction which was what he actually did yesterday. Also following up from last night's blog closing sentence discussing the -145 Advance Decline left lots of room for Bernanke to spread the rally to the full breadth of stocks over the next couple of days which is what he actually did today.

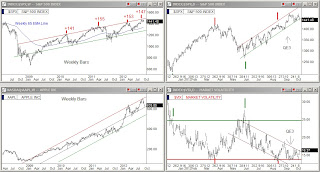

This lift he has created by taking these two steps is showing up on all the major indexes now as shown in the charts above. In the left column, the Nasdaq and SPY, we see the smooth gradual red / blue 5/20 EMA layup beginning. In the bottom left corner, we see the DOW's red/green 5/10 EMA layup beginning. In the center column, the S&P 500 and Russell 2000 (IWM Russell 2000) have their red/blue 5/20 EMA layups beginning. Below the IWM Russell 2000 we see the QQQ which lost it several days ago mainly because of AAPL's funk but its 5 EMA has managed to claw its way back up on to the blue 20 EMA line and start lifting.

In the far right column the VIX (Volatility Index), VXX (VIX Futures), and the UUP (Dollar Index) are turning substantially downward now, a reflection of the strength of the 5/20 layup starts that Bernanke has crafted over the past two days hitting AAPL hard the first day and then shifting the push to the full breadth of stocks today.

The daily 5/10/20 EMAs of all the indexes now have bullish setups that are just about as high quality as they get. The only thing keeping us from a follow through into several days of rally here would be if AAPL starts to get really heavy again. AAPL's charts are shown in the cluster below and we see that its price could not break up through the blue 20 EMA line in the top left chart of that cluster where it also found resistance yesterday afternoon. This AAPL situation must be monitored closely since if it were to worsen, AAPL could tip the punch bowl over by itself.

Alan

AAPL & Big Picture Clusters shown below:

Click on image to enlarge

Click on image to enlarge

Click on image to enlarge