Stock Market Technical Analysis

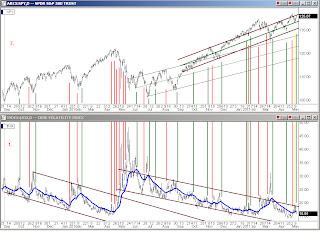

The markets put in a modest gain today. It began the moment the VIX slipped through its blue bull/bear line in row 2. This gave the SPY a decent candle in the upper right chart today as it lifted up from the lower line of its long term brown channel. ( I thickened the lines of this brown line channel and converted the black channel to thin lines as the brown channel now becomes the primary channel) I suspect a lot of traders opened swing trades to the upside today. If so they must be closely monitored.

The real test of market direction will happen when the SPY gets up to the the 3 month orange shelf line. If it can't get above it then this is all just buying time.( also it must cross back up into the black line channel at the same time, this won't be easy)

The VIX, in row 2 has its own big test coming - the 16 level, where I have a thin black line drawn. The chart shows how it has turned up from there a couple times recently, and we are right down to it with today's close.

The UUP is also going to be put to a test tomorrow as it is right down to its blue bull/bear line where it could easily bounce back up from it instead of crossing down through.

Day by day market continues..

Alan

Stock Market Analysis - Large Cap Swing Trades - Momentum Stocks - Low Cost Option Plays Position Trades for Self-Directed IRAs

Stock Market Viewpoint

Reading the Tea Leaves...

Thursday, May 26, 2011

Wednesday, May 25, 2011

A little more improvement 5/25/11

Stock Market Technical Analysis

Click on above image to enlarge

We got our first real day of improvement as I mentioned I was looking for last night. The market had a decent day today although the choppiness intraday is continuing. In the top row, right chart shows that the SPY is holding the lower line of the longterm thin line brown channel for the third day. On the left chart of the top row, the SPY will either have to break out of the downhill pink channel and be free to run in the brown channel or the pink channel will force the price down out of the brown channel. This is called a forced channel switch and it's not done until it's done. In the second row, the VIX opened at the underside of its upper brown channel line and quickly broke down through its uphill red channel causing a nice morning rally and in the afternoon dropped below the blue bull/bear line triggering a second rally that was short lived as the VIX quickly rose back up and closed right on the blue line leaving it positioned with a neutral bias for tomorrow's open.

In the lower chart, the UUP (dollar) caused a lot of concern today as it is also closed in a neutral bias if not slightly upward biased. We are certainly not out of the woods yet but if we get one more day of modest improvement it might be enough to establish an upward direction for a while. The only problem is the jobs report in the morning. If it is bad news, all bets are off.

Alan

Tuesday, May 24, 2011

Holding the line 5/24/11

Stock Market Technical Analysis

Click on above image to enlarge

Today was another day of sidways choppy trading in the market but bias has shifted slightly to the bull side as of this evening. In the top row, the top left 120 min chart shows we are still holding the light brown line secondary channel and on the day chart just to the right of it we see that the longterm uphill thin brown line channel has held the lows for yesterday and today. Dropping to the second row, the VIX opened below its upper brown channel line then dropped down to the blue bull/bear line and bounced part of the way back up but still closed well inside the upper brown channel line which is a definite improvement over yesterday. Also in the lower chart, the UUP drifted downward today helping the overall picture of the markets.

Even though we are basing here for two days on the longterm day chart lower channel line, the trading has been choppy and erratic mostly because traders are focusing on 15 and 5 minute charts. The intraday plays are coming off of that which often contradicts what the day chart says which is causing the intraday chaos. If the overall conditions in these charts can improve a little more tomorrow, we might be able to put together the start of a new leg up because the day chart 5ema is trying to bounce from its 50ema, a key reversal point in the big picture (sorry, I didn't get this chart posted tonight).

Alan

Monday, May 23, 2011

The good, the bad, and the ugly 5/23/11

Stock Market Technical Analysis

Click on above image to enlarge

First the ugly, today's trading was worse than ugly. An avalanche of sellers piled in around 1:30pm today. The bad, we dropped through and closed below the SPY's steep black channel and the orange shelf line going back 3 months. Also, the UUP had a big gap up premarket.

The good, today's bottom did catch two other channel lines - the light brown channel in Day SPY chart at the top right and the light brown secondary channel in the 120min bar chart of the SPY in the top left.

A neutral angle on the picture is that after the VIX gapped open at 20 and fell it ended up closing right on its upper brown channel line leaving it sitting neutral for the open tomorrow morning.

If there is going to be a QE3 announced, tomorrow morning would sure be a nice time to do it.

Alan

Friday, May 20, 2011

Dollar sideswipes rally 5/20/11

Stock Market Technical Analysis

Click on above image to enlarge

In the markets today the US Dollar (UUP) came onto the playing field to break out of a 6 month downtrend. The moderately correlated inverse relationship between the Dollar and the stock market has been disconnected when the Dollar has been downtrending for the last 6 months. Two weeks ago the UUP popped above its bull/bear blue line as can be seen in the lower chart I added this evening. Today was the big pivot day for the UUP because after yesterday's selldown it looked to fall back in its brown channel and also cross back down below into its blue line. During the early hours of this morning, Greece's problems took the headlines and caused a 7am gap up in the UUP totally reversing its four day downtrend.

If today's marked breakout in the dollar follows through, the pattern has been for the inverse relationship between the market and the UUP to return as long as the UUP is in an overall uptrend. Those who follow the market regularly understand the forces behind the scenes trying to take this market higher to potentially pull the economy higher but if we are seeing the return of the inverse relationship of the UUP and stock market, trading can become very volatile and erratic as it did last summer. It's too soon to say for sure if the UUP is beginning a sustained uptrend but having its pivot breakout to the upside wreaked havoc on the market intraday today. We had a huge intraday selloff in the morning, then a run back off, then selling off again before the bell. Summer trading is essentially here and if the UUP actually is returning as a strong market influence it will likely be a summer of great volatility.

Looking at the VIX chart we crossed back up to the bear side of the blue line and also closed barely back up in the red bear channel. In the top chart, the SPY closed very slightly below the 3 month horizontal orange shelf line, leaving us in a neutral to moderately bearish bias for Monday. I feel like there might be an effort Monday to seriously support the SPY at that 3 month horizontal orange line.

Alan

Thursday, May 19, 2011

VIX Breaks Down 5/19/11

Stock Market Technical Analysis

Click on above image to enlarge

Today the VIX broke down through the shelf line level established last week. This allowed another day of modest climb on the SPY. I overlayed a 120 minute SPY bar chart onto the Day Candle chart of the SPY. It gives a closer view of the short term trend lines of the SPY and makes price patterns easier to spot. The odds favor another up day on the indexes tomorrow.

Alan

Wednesday, May 18, 2011

Market Rally Materializes 5/18/11

Stock Market Technical Analysis

Click on above image to enlarge

The market rallied nicely today because the VIX failed to break up thru its brown upper channel line yesterday along with the SPY having a hammer reversal candle sitting on the lower line of its one week pink downhill channel.

Also as I mentioned last night, as soon as the VIX crossed below its blue bull/bear line and down thru the lower line of its red uphill channel the market kicked in for a second wave up in the afternoon to finish with the S&P Index +12 and the Nasdaq +32.

Looking toward tomorrow, the VIX looks free to fall lower and will if the SPY can successfully break out of the top line of its downhill pink channel where it closed at today. The momentum looks strong enough to carry us thru but closing at the pink line leaves us vulnerable at the open, but the SPY must get free and clear of that pink downhill quickly to get the bear camp to flip and join the bulls for a multi day rally. Tomorrow's open will be the bears moment to try and nip this rally in the bud. If there is no bad economic news out in the premarket the bias should remain to the upside tomorrow.

Alan

Tuesday, May 17, 2011

Market Technicals Lean Toward a Good Rally Wednesday 5/17/11

Stock Market Technical Analysis

Click on above image to enlarge

A broad list of market intraday and daily chart technical indicators reversed at 1:30pm this afternoon shifting the bias to the bull camp for tomorrow. In the lower VIX chart, the VIX broke out of it's brown channel but quickly reversed back into it closing well down close to the blue line. This will be considered as a successful test of that channel line. In the upper chart of the SPY, today's candle is a hammer reversal candle also positioned on the lower line of the pink downhill channel which would easily lend to a rally to the upper pink channel line over the next couple of days. If the market is going to be pushed up tomorrow, I am expecting some sort of good economic data surprise to show up on the news wires in premarket. If we rally in the morning the real test will come when the VIX candle drops down to the blue line which will be laying right on the lower line of the red uphill VIX channel which would cause an explosive lift into an afternoon rally if the VIX breaks down thru both the blue line and lower red channel line.

Alan

Monday, May 16, 2011

Market Downtrending 5/16/11

Stock Market Technical Analysis

Click on above image to enlarge

Today the VIX continued higher above the blue line from yesterday afternoon's cross to the topside causing another mild selloff on the indexes. On the upper chart, the SPY, we can see we are clearly downtrending away from its upper channel line. The market is still under the sell signal from yesterday afternoon but if the VIX breaks above the brown channel line tomorrow it will trigger an additional sell signal.

Alan

Sunday, May 15, 2011

Four Days, Four Market Reversals 5/15/11

Stock Market Technical Analysis

Click on above image to enlarge

The market whipsaw continues with Friday's closing of the VIX in the lower chart being slightly above the blue line for a slightly bearish bias.

Alan

Tuesday, May 10, 2011

VIX drops today...5/10/11

Stock Market Technical Analysis

Click on above image to enlarge

With this morning's open the VIX dropped through the blue line in the lower chart for a buy signal on the broad market. Volume was low today as people can see that the SPY shown in the upper chart reached its upper trendline in this first day of the move. Some may short here and if WallStreet wants to squeeze them the SPY may break above its upper brown channel line as it did a couple of weeks ago. Normally setups of this type are good for 2-4 days of upward trading but tomorrow the market is likely to go sideways at the upper brown line until we see if it can pop above it again.

Alan

Monday, May 9, 2011

VIX / SPY Charts

Click on above image to enlarge

I am returning to my blog posts after 3 month's off from trading. I highly recommend it to anyone that does this year after year, if you don't you will reach burnout at some point.

I posted tonight's charts that show how the VIX is a leading indicator on the SPY. In the lower chart, when the VIX crosses the blue line to the topside it is viewed as a sell signal on the market and when it crosses through the blue line to the downside it is widely viewed as a buy signal on the market. Also, when the VIX breaks out of its trading range marked by the brown channel lines it becomes an additional buy or sell signal on the market. Last Monday, 5/2, the VIX crossed above the blue line and marked a sell signal on the market which is drawn with a red line and transferred up to the SPY chart. Last Friday, it was threatening to break out of the brown channel line for an additional sell signal on the market but today it fell back down to the blue line and closed there leaving the market with no directional bias which is reflected in the yellow caution line transferred up into the SPY chart.

Alan

Subscribe to:

Posts (Atom)

Blog Archive

-

▼

2011

(118)

-

▼

May

(12)

- We have lift 5/26/11

- A little more improvement 5/25/11

- Holding the line 5/24/11

- The good, the bad, and the ugly 5/23/11

- Dollar sideswipes rally 5/20/11

- VIX Breaks Down 5/19/11

- Market Rally Materializes 5/18/11

- Market Technicals Lean Toward a Good Rally Wednesd...

- Market Downtrending 5/16/11

- Four Days, Four Market Reversals 5/15/11

- VIX drops today...5/10/11

- VIX / SPY Charts

-

▼

May

(12)