Stock Market Technical Analysis Blog

Click on image to enlarge

In the market today we have the Fed policy statement without mention of tapering in September or at any time which gave the market a brief rally in the late afternoon but gave it all back into the bell. While the worries of Fed tapering are on the backburner for the foreseeable future, the market is still wrestling with being up so much in the last 6 months and the immediate situation of the VIX and the S&P being so close to their 15 EMA lines shown in blue in the two charts at the top. Today's bar on the S&P ended as a shooting star from the post speech rally then the pullback. The VIX did the opposite, dropping hard at the speech then coming back up at the bell for an upward biased hammer candle. The closing number on the VIX was once again just below the blue 15 EMA line and the closing number on the S&P was just a little above its 15 EMA line. As long as the VIX doesn't close above the line and the S&P doesn't close below its line then the market is still in business and this might end up being just a consolidation area. However, the VIX needs to start moving down away from its blue 15 EMA line asap because the longer it stays so close to it the longer the market is vulnerable to a line crossing triggered selloff.

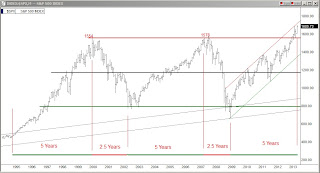

The second chart above is a 20 year chart of the S&P and the chart below it shows the breakdown in the bond market as the great bond bubble starts to deflate.

Trade well my friends

Alan