Stock Market Technical Analysis

Click on above images to enlarge

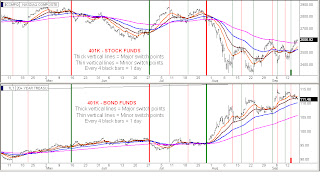

The top chart set shows the NASDAQ with this year's major brown line channel just above it and also the VIX with its position in major brown line channel. On 8/5 the NASDAQ fell out of its horizontal brown channel & the VIX broke into the upper half of its huge brown channel. Since then the stock market has not been a friendly place. This evening the NASDAQ is on the threshold of popping back up into this year's primary horizontal brown channel and the VIX is on the threshold of dropping down into the lower half of its huge brown line channel - the stock friendly half. If the VIX drops down thru tomorrow it will also cross below its pink 50 day ema line shown which should be an accelerant for the stock market. The NASDAQ crossed above its 50 day ema yesterday afternoon. This could be THE major pivot point this year. Granted if it happens, it is not likely to happen all in one day and we will probably have up and down oscillations inside the 6-week thin red line channels. However, it could be a turning point that draws people back into the stock market.

In the middle 401k charts set, we are getting very close to a major bonds to stock switch point for those who switched from stocks to bonds at the thick green line shown in the bond chart back on 7/28. In that chart if the gold line crosses down thru the brown line, that would be widely considered an exit point and I will mark in a thick red line showing that I believe this is the ideal switch back to stocks point for those that have been in bonds for the past seven weeks since 7/28. The gold line must clearly cross all the way down thru and not bounce back up as you can see that it did on 9/1.

In the lower set of charts you can see that the UUP (Dollar Index) in the lower bottom left corner has stopped its descent on its lower line of its long term black line uphill channel as Dollar traders watch to see if the VIX is going to drop down into the lower half or not. The NASDAQ is pushing up against its upper blue channel line right now attempting a breakoout which would also take it back into that year-long horizontal brown line channel in the top set of charts. The SPY has worked its way out of its short term pink line channel today and has several dollars of room above it before it gets up to its upper blue channel line.

Tonight I am simply focusing on the fact that the stock market is at a major pivot point. The forces that have been bringing the market up the past few days must continue in order for this to happen. Nonetheless, Wall Street goes in big at major pivot points if they believe that the public will also. The key is the public must come in if we cross this threshold and give us some good volume days because if they don't Wall Street is not likely to sponsor a prolonged move up alone.

Major pivot points are huge events & no one can predict how they will turn out. Taking another view you must realize that the NASDAQ may get knocked down by the bottom line of its year-long brown channel & the VIX may bounce up from the center line of its huge brown channel instead of crossing down into the the stock friendly lower half.

Nontheless, if you know when we are at a major pivot you have a perspective that is a real advantage in managing your investing.

Alan

Please see risk disclaimer below

In the lower set of charts you can see that the UUP (Dollar Index) in the lower bottom left corner has stopped its descent on its lower line of its long term black line uphill channel as Dollar traders watch to see if the VIX is going to drop down into the lower half or not. The NASDAQ is pushing up against its upper blue channel line right now attempting a breakoout which would also take it back into that year-long horizontal brown line channel in the top set of charts. The SPY has worked its way out of its short term pink line channel today and has several dollars of room above it before it gets up to its upper blue channel line.

Tonight I am simply focusing on the fact that the stock market is at a major pivot point. The forces that have been bringing the market up the past few days must continue in order for this to happen. Nonetheless, Wall Street goes in big at major pivot points if they believe that the public will also. The key is the public must come in if we cross this threshold and give us some good volume days because if they don't Wall Street is not likely to sponsor a prolonged move up alone.

Major pivot points are huge events & no one can predict how they will turn out. Taking another view you must realize that the NASDAQ may get knocked down by the bottom line of its year-long brown channel & the VIX may bounce up from the center line of its huge brown channel instead of crossing down into the the stock friendly lower half.

Nontheless, if you know when we are at a major pivot you have a perspective that is a real advantage in managing your investing.

Alan

Please see risk disclaimer below